May 8, 2014, Vancouver, B.C., Wellgreen Platinum Ltd. (TSX-V: WG, OTC-QX: WGPLF)

As a result of a review of the Company’s disclosure record by the British Columbia Securities Commission (the “BCSC”), the Company is issuing this news release to clarify and retract certain previous disclosure made by the Company concerning its Wellgreen and Shakespeare projects.

Clarification of Wellgreen Project Technical Disclosure

Non-Compliant Disclosure of Alternate Scenarios based on the 2012 Wellgreen Preliminary Economic Assessment (“2012 Wellgreen PEA”)

The Company has previously, in certain of its investor presentation materials and on its website, made disclosure relating to metal price, production summaries and net present value scenarios relating to the Wellgreen project which are not contemplated in the 2012 Wellgreen PEA (a technical report in respect of the 2012 Wellgreen PEA was filed on SEDAR by the Company on August 9, 2012). The Company acknowledges that this prior disclosure was contained in the Company’s corporate presentation and investor fact sheet that were posted to the Company’s website as recently as April 2014. The Company further acknowledges that such disclosure used factors that reduced certain metal price assumptions to 30% below the base case scenario contemplated in the 2012 Wellgreen PEA, which resulted in a significantly lower net present value (NPV) figure than the base case. In addition to not being based solely on the 2012 Wellgreen PEA, such disclosure was not supported by the sensitivity analysis contained in the 2012 Wellgreen PEA, and therefore effectively amounted to the disclosure of a new PEA result. This disclosure was an internal re-interpretation, partly based on the 2012 Wellgreen PEA, but was not prepared to the standard of a preliminary economic assessment and was not suitable for disclosure because it was not supported by a technical report. The Company acknowledges that such prior disclosure was contrary to National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Company retracts all such disclosure, and cautions investors not to rely on any economic assessments outside of those expressly contained in the 2012 Wellgreen PEA.

The Company also clarifies that the 2012 Wellgreen PEA remains current, valid and relevant. In particular, the Company directs investors to the Base Case LME 3 year average metal prices minus 20% scenario for the project in the 2012 Wellgreen PEA as being reflective of the current metal price environment. The 2012 Wellgreen PEA technical report is available under the Company’s SEDAR profile at www.sedar.com, and is also available on the Company’s website: www.wellgreenplatinum.com/pdf/2012_Wellgreen_PEA.pdf.

Investors should note that the 2012 Wellgreen PEA is preliminary in nature, in that it includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2012 Wellgreen PEA will be realized. A mineral reserve has not been estimated for the project as part of the 2012 Wellgreen PEA. A mineral reserve is the economically mineable part of a measured or indicated mineral resource demonstrated by at least a pre-feasibility study. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The foregoing statements were reviewed and approved by John Sagman, P.Eng., the Company’s Senior Vice President and Chief Operating Officer, and a “Qualified Person” as defined in NI 43-101.

Absence of Post-Tax Analysis in the 2012 Wellgreen PEA

The Company notes that the 2012 Wellgreen PEA did not include an analysis of after-tax economics as required under NI 43-101. Accordingly, the Company provides the following summary of the tax environment in the Yukon for the Wellgreen project. Generally speaking, applicable taxes for mining in the Yukon Territory currently include a 15% federal income tax rate and a 15% territorial income tax rate. Under the Quartz Mining Act, a royalty of up to 12% of profits from mining may also be payable to the Yukon government. Generally speaking, income taxes are applicable to pre-tax cash flow from operations less royalties, capital cost allowance, interest expenses, non-capital carry forward losses and Canadian exploration expenses and Canadian development expenses. Generally speaking, royalties are based on profits minus a number of deductions, including development allowance, depreciation allowance, community and economic development expense allowance, plus other incentives for mining exploration activity.

Non-Compliant Disclosure of Potential Exploration Targets

On page 10 of the 2013 Annual MD&A the following was stated regarding the Company’s Wellgreen project:

The Company notes that this statement may be interpreted as an economic analysis of exploration targets, and that such disclosure is restricted under NI 43-101 and is also deficient in that it was not accompanied by the cautionary language required under section 2.3(2)(a) of NI 43-101. Accordingly, the Company retracts this statement from the 2013 Annual MD&A and cautions investors not to rely on this statement.

Disclosure of Potential Metallurgical Recovery Targets

The Company notes that it has previously disclosed, in its investor presentation materials and on its website, metallurgical recovery targets for its Wellgreen project that are objectives for the project and have not yet been achieved. The Company cautions investors that such information is forward-looking and should not be interpreted to mean that any such targets have actually been, or will ever be, achieved. Metallurgical test work is on-going and includes studies designed to optimize the grinding requirements, flotation reagents, and the process flow sheet including a magnetic separation process for the relevant metallurgical domains. An important focus of this work has been to assess the potential to improve recovery levels, particularly for platinum, palladium and gold versus the levels in the 2012 PEA. This work is still in progress and, upon completion of the current metallurgical sample test work, the results will be used to generate recovery and concentrate grade assumptions for the key metallurgical domains in the updated Preliminary Economic Assessment for the Wellgreen project.

Timing for updated PEA on the Wellgreen Project

The Company notes that it is continuing its work on completing an updated PEA on the Wellgreen project, and anticipates completing the updated PEA by July 2014.

Retraction of Shakespeare Feasibility Study and Mineral Reserves

The Company has determined that the January 2006 feasibility study (“2006 Feasibility Study”) in respect of the Shakespeare project, and the information contained therein with respect to mineral reserve estimates, is no longer valid, and that investors should not rely on the viability of economic or production estimates based on the 2006 Feasibility Study because the operating and capital expenditures estimated therein are outdated and no longer reliable. Accordingly, the Company retracts the 2006 Feasibility Study and announces that the Shakespeare project does not currently contain any mineral reserves, as such term is defined for the purposes of NI 43-101.

Shakespeare Mineral Resources

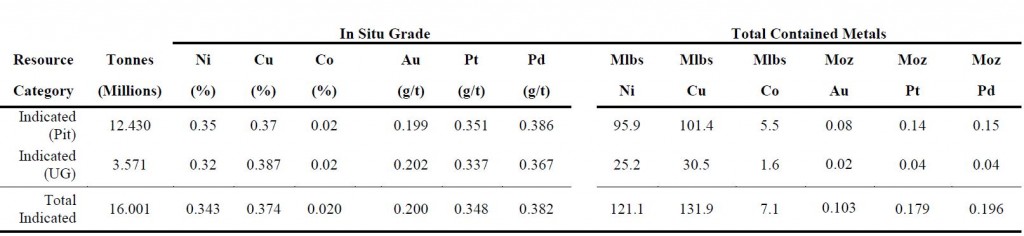

The Shakespeare project currently has Indicated and Inferred resources, as summarized in the following table. The Indicated (Pit) resource is prior to mining depletion from historic production, which totaled approximately 0.4 million tonnes from 2007 to 2011:

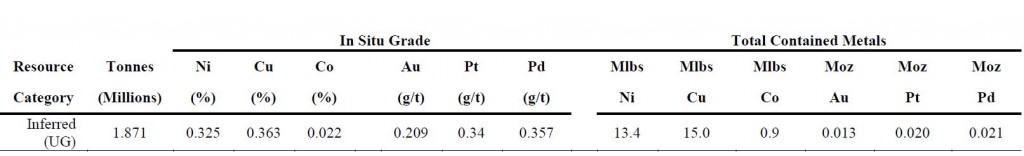

The Shakespeare project also has an Inferred resource of 1.9 million tonnes, as summarized in the following table:

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Non-Material Status of Shakespeare Project

The Company has determined that the Shakespeare project is not a material property of the Company for a number of reasons, including, but not limited to, the fact that the 2006 Feasibility Study is no longer reliable, and the project’s significantly smaller scale as compared with the Company’s core Wellgreen PGM-Ni-Cu project. The Company notes that the Shakespeare project has not been a significant focus of the Company and has remained on care and maintenance since the Company acquired the project in July 2012, with minimal expenditures. Indeed, during the period from the Company’s acquisition of the Shakespeare project up to December 31, 2013, the Company has spent a total of $677,642 on the project, which includes $474,409 in project expenditures and $203,333 in care and maintenance expenditures. By contrast, during the period from the Company’s acquisition of its flagship Wellgreen project in June 2011 up to December 31, 2013, it has spent approximately $15.3 million on the Wellgreen project.

The Company accordingly confirms that it has no mine development or production plans with respect to the Shakespeare project over the near term. Furthermore, there are no studies or work being carried on at this time on the project. The Wellgreen project has been and remains the Company’s core focus, and is currently the only material property of the Company.

Other Clarification

Reporting Gross In-Situ Metal Value

On March 6, 2013, the Company issued a news release (the “March 6, 2013 News Release”) reporting the release of its unaudited interim consolidated financial statements for the three and nine months ended December 31, 2012 and an update on the Company’s projects. Certain disclosure in the March 6, 2013 News Release included the gross combined dollar value of contained platinum, palladium and gold expressed as US$/share, which amounted to disclosure by the Company of gross in-situ metal value. The Company notes that such disclosure may be misleading because it fails to take into consideration operating and capital costs, recoveries, smelter costs and other factors relating to the potential mining, extraction and recovery of metals. Accordingly, the Company retracts this disclosure from the March 6, 2013 News Release, and cautions investors not to rely on such disclosure.

Qualified Person: All scientific and technical information disclosed herein was reviewed and approved by John Sagman, P.Eng., Wellgreen Platinum’s Senior Vice President and Chief Operating Officer, and a “Qualified Person” as defined in NI 43-101.

Wellgreen Platinum Contacts:

|

Chris Ackerman |

Further information about the Company and its projects can be found at www.wellgreenplatinum.com.

Forward Looking Information: This news release includes certain information that may be deemed “forward-looking information”. Forward-looking information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. All information in this release, other than information of historical facts, including, without limitation, the potential of the Wellgreen project, information regarding the timing of future technical reports and general future plans and objectives for the Wellgreen project are forward-looking information that involve various risks and uncertainties. Although the Company believes that the expectations expressed in such forward-looking information are based on reasonable assumptions, such expectations are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking information. Forward-looking information is based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from the forward-looking information include unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, the Company’s ability to maintain the support of stakeholders necessary to develop the Wellgreen project, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulatory authorities in Canada. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking information. For more information on the Company and the risks and challenges of our business, investors should review our annual filings which are available at www.sedar.com. The Company does not undertake to update any forward looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

420-1090 West Georgia Street

Vancouver, BC Canada V6E 3V7

© Copyright 2014 Wellgreen Platinum Ltd. All Rights Reserved