Wellgreen Platinum Announces Results from Drilling at the Wellgreen PGM-Nickel Project December 21, 2015, Vancouver, B.C. – Wellgreen Platinum Ltd. (TSX: WG; OTC-QX: WGPLF) (“Wellgreen Platinum” or the “Company”) is pleased to announce the results of its previous two exploration drilling and field work programs at its 100%-owned Wellgreen PGM-Nickel project, located in Canada’s Yukon Territory.

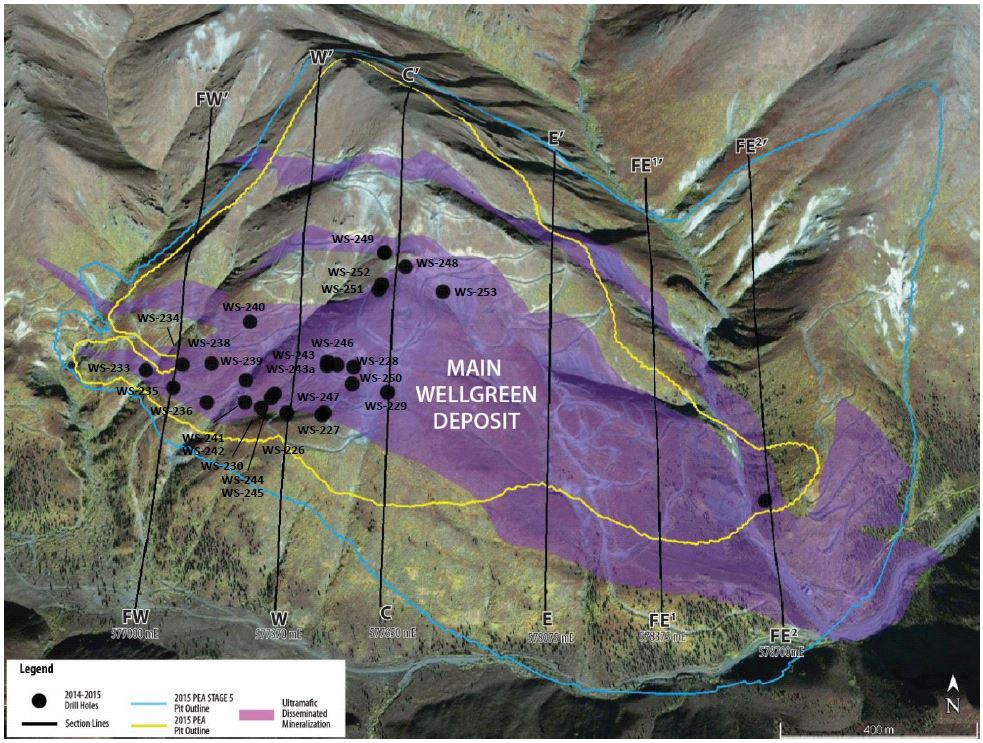

Utilizing both diamond core and reverse circulation (“RC”) drill rigs, Wellgreen Platinum drilled 2,867 metres of diamond drill core and 3,528 metres of RC chip samples for a total of 6,395 metres. A drill program was undertaken in the Far West, West, Central and Far East Zones to test down-dip extensions to known disseminated mineralization, as well as areas of higher grade mineralization. Step-out holes 100 metres down-dip of known mineralization were targeted in the West, Central and Far East Zones. The drill program confirmed the extension of long intervals of disseminated mineralization hosted in peridotite, clinopyroxenite and gabbro. Additionally, in the Far East Zone, one 90 metre step out drill hole confirmed higher grade, marginal gabbro and contact massive sulphides.

Assay results from the drill program demonstrate both the continuity of disseminated mineralization in the southern areas of the PEA Base Case Open Pit described in the Company’s technical report1 and the potential for significant expansion of higher grade mineralization in the deeper regions of the Far East Zone. In the Far East Zone, the results indicate that deeper disseminated mineralization and mineralization in footwall contact zones, which are below the 2015 PEA Base Case Open Pit, are not well defined and further exploration at depth in this area is required.

12015 PEA Technical Report on the Wellgreen project entitled “Preliminary Economic Assessment Technical Report, Wellgreen Project, Yukon Territory, Canada”, which is dated effective 2/2/2015 and available under the Company’s profile on Sedar.com. A PEA is preliminary in nature, in that it includes an economic analysis that is based, in part, on Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them which would allow them to be categorized as Mineral Reserves, and there is no certainty that the results will be realized. Mineral Resources are not Mineral Reserves because they do not have demonstrated economic viability.

The Company expects to continue drilling at Wellgreen until the end of the year and is currently planning an additional exploration drilling program with the objective of confirming further Measured and Indicated mineral resources. The results from these programs, along with those from the current campaign, are expected to develop an updated geological deposit model that will form the basis of a Pre-Feasibility Study. In parallel, the Company will focus on continuing high priority metallurgical and process engineering studies while continuing environmental baseline, assessment and mitigation studies. In addition, Wellgreen Platinum will conduct a modest exploration program to continue to advance our understanding of the entire deposit.

John Sagman, Wellgreen Platinum’s Interim President & COO, commented, “The results from our most recent exploration campaigns are consistent with those from previous programs and are encouraging as they continue to support our confidence in both the continuity and grade of mineralization and provide a greater understanding of this large deposit. In addition to the drilling program currently underway at the Wellgreen project, the Company is segregating representative Life of Mine Plan samples from recent programs to be utilized for metallurgical testing in 2016. This testing is targeting early mine production material with the objective of optimizing the mill flow sheet and recoveries, along with testing the ability to produce separate nickel and copper concentrates.”

West Zone Drilling

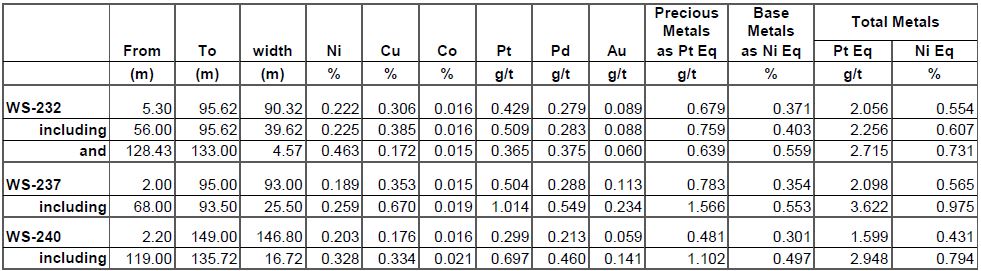

Previous drill results in the West Zone warranted follow up work with additional drilling along the main mineralization trend. Three new drill holes all encountered mineralization, with holes WS-232 and WS-237 each intersecting over 90 metres grading above 2.0 g/t Platinum Equivalent (“Pt Eq.”) or 0.55% Nickel Equivalent (“Ni Eq.”) (Refer to table below for full assay results and notes describing the metal prices used to determine metal equivalents). Drill hole WS-240 was terminated early due to poor drilling conditions.

West Zone Drill Results

Footnotes to Drill Tables: (1) Nickel equivalent (Ni Eq. % Total) and platinum equivalent (Pt Eq. g/t Total) calculations reflect total gross metal content using US$ of $6.50/lb nickel (Ni), $2.50/lb copper (Cu), $12.50/lb cobalt (Co), $1200/oz platinum (Pt), $675/oz palladium (Pd) and $1250/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are reflective of the approximate LME 3-year trailing average metal prices. (2) Ni Eq. % Base Metals and Pt Eq. g/t Precious Metals refer to equivalents of base and precious metals respectively, not total metals (3) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (4) Cutoff grade of 0.15% Ni Eq. (5) Internal dilution up to six continuous metres of <0.2% Ni Eq. (6) Notable sub-intervals defined as minimum 20g-m Pt Eq. and 0.5% Ni Eq. Total composite grade (7) Some rounding errors may occur.

“The long, continuous intervals of disseminated mineralization intersected in the West Zone align with the grades anticipated by 2015 PEA block model.” stated John Sagman, Wellgreen Platinum’s Interim President & COO. “An understanding of the more robust geology encountered at depth continues to be developed.”

West to Central Zone Drilling

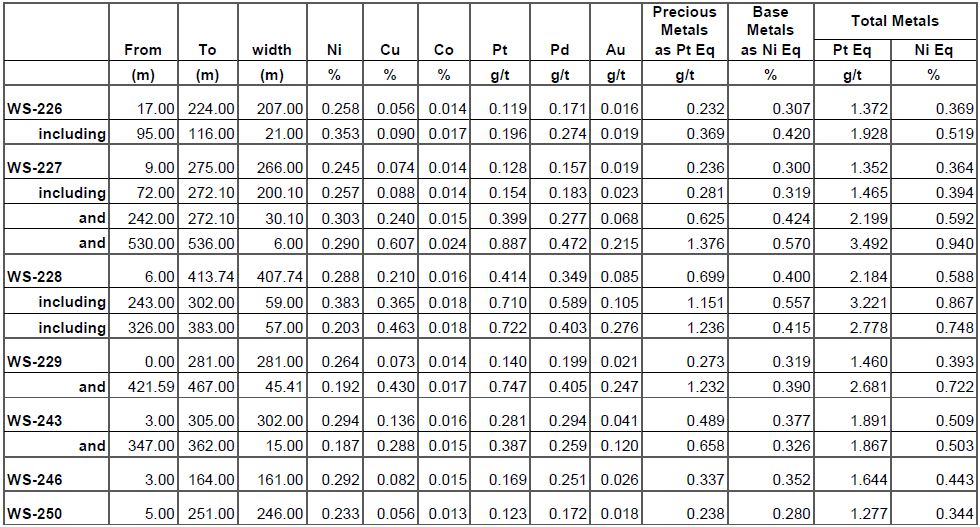

A drill program conducted across the West and Central Zones focused on upgrading Inferred mineral resources from the 2015 PEA to the Measured and Indicated mineral resource categories and to confirm higher grade mineralization trends within the main deposit area.

Drill hole WS-228 intersected 407.7 metres of continuous mineralization grading 2.18 g/t Pt Eq. or 0.59% Ni Eq. and included a 59.0 metre intercept grading 3.22 g/t Pt Eq. or 0.87% Ni Eq. This confirmed an extension of the long intervals of disseminated mineralization encountered in drill holes WS-226 and WS-227, which represents a 100 metre westward extension of more clinopyroxene-rich, higher grade material previously intersected by key historic drill holes WS-188 and WS-214. WS-228 was terminated in mineralized material at 413.7 metres due to challenging drilling conditions. Additional exploration at depth will be required in this area to establish how far the mineralization extends toward the country rock boundary.

Drill hole WS-229 intersected 281.0 metres of continuous mineralization grading 1.46 g/t Pt Eq. or 0.39% Ni Eq. This confirmed further extension of long intervals of disseminated mineralization encountered in drill holes WS-226, WS-227 and WS-228. Where drilling was expected to intersect a down-dip extension of more clinopyroxene-rich higher grade material, drill hole WS-229 instead intersected country rock for 158.6 metres before intersecting a further 45.4 metres of mineralized ultramafic from 421.6 to 467.0 metres grading 2.68 g/t Pt Eq. or 0.72% Ni Eq. Drill hole WS-229 offers valuable insight into previously unrecognized complexity in the intrusive-country rock contact at depth first encountered in drill hole WS-227. In addition, it confirmed a 33.4 metre zone of contact mineralization in proximity to a basement sediment wedge as predicted by the 2015 PEA.

West to Central Zone Drill Results

Footnotes to Drill Tables: (1) Nickel equivalent (Ni Eq. % Total) and platinum equivalent (Pt Eq. g/t Total) calculations reflect total gross metal content using US$ of $6.50/lb nickel (Ni), $2.50/lb copper (Cu), $12.50/lb cobalt (Co), $1200/oz platinum (Pt), $675/oz palladium (Pd) and $1250/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are reflective of the approximate LME 3-year trailing average metal prices. (2) Ni Eq. % Base Metals and Pt Eq. g/t Precious Metals refer to equivalents of base and precious metals respectively, not total metals (3) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (4) Cutoff grade of 0.15% Ni Eq. (5) Internal dilution up to six continuous metres of <0.2% Ni Eq. (6) Notable sub-intervals defined as minimum 20g-m Pt Eq. and 0.5% Ni Eq. Total composite grade (7) Some rounding errors may occur.

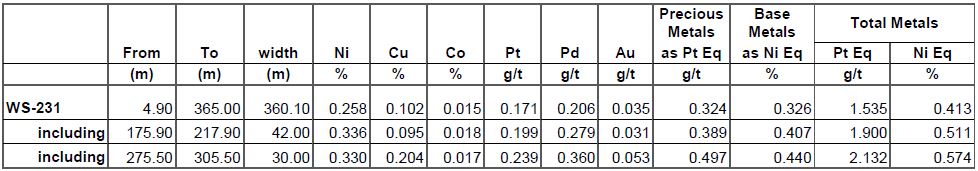

Far East Zone Drill Results

Drill hole WS-231 intersected 360.1 metres of continuous mineralization grading 1.54 g/t Pt Eq. or 0.41% Ni Eq., and included several higher grade intervals such as 30.0 metres of 2.13 g/t Pt Eq. or 0.57% Ni Eq. in marginal gabbro and massive sulphide at the footwall contact. This intersection, when correlated with previously discovered mineralization encountered in drill holes WS-177 and WS-178, suggests a sub-horizontal, mineralized contact in the Far East Zone that extends to the south.

Far East Zone Drill Results

Footnotes to Drill Tables: (1) Nickel equivalent (Ni Eq. % Total) and platinum equivalent (Pt Eq. g/t Total) calculations reflect total gross metal content using US$ of $6.50/lb nickel (Ni), $2.50/lb copper (Cu), $12.50/lb cobalt (Co), $1200/oz platinum (Pt), $675/oz palladium (Pd) and $1250/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are reflective of the approximate LME 3-year trailing average metal prices. (2) Ni Eq. % Base Metals and Pt Eq. g/t Precious Metals refer to equivalents of base and precious metals respectively, not total metals (3) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (4) Cutoff grade of 0.15% Ni Eq. (5) Internal dilution up to six continuous metres of <0.2% Ni Eq. (6) Notable sub-intervals defined as minimum 20g-m Pt Eq. and 0.5% Ni Eq. Total composite grade (7) Some rounding errors may occur.

John Sagman, Wellgreen Platinum’s Interim President & COO, noted, “The long, continuous interval of disseminated mineralization intersected in the Far East Zone aligns with the grades anticipated by the 2015 PEA block model. The high grade mineralization encountered at the basal contact may be an extension down-plunge of the sub-horizontal gabbro in the East Zone and its associated high-grade sulfide mineralization. This mineralization remains open down-dip.”

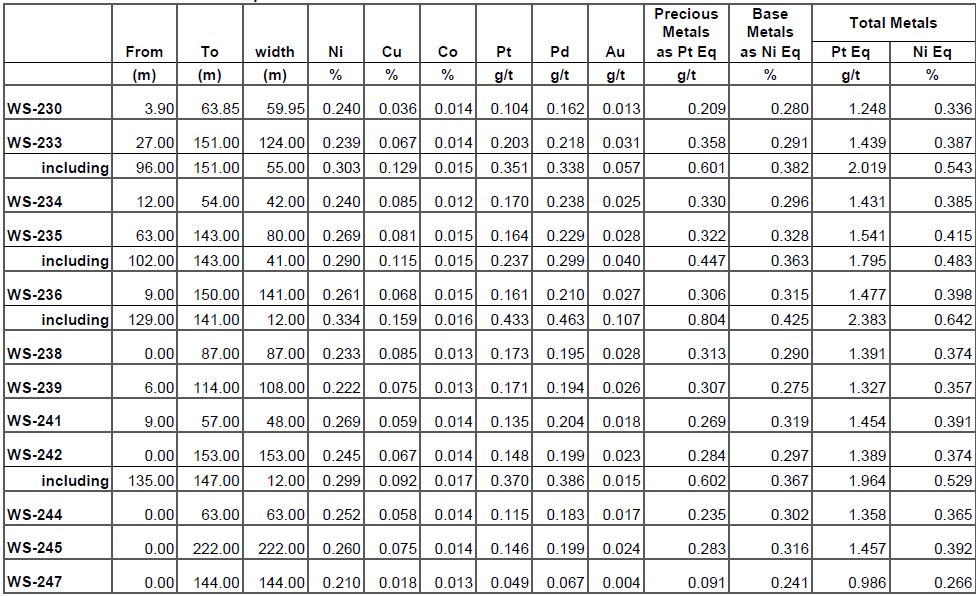

Far West and West Zone Pit Expansion Area

A drill program in the Far West and West Zones was designed to explore past the first three stages of the 2015 PEA open pit along the southwestern area, and to expand these early stage open pits into the boundary of the 2015 PEA Base Case Pit. This drill program was successful and is expected to support the conversion of significant tonnes from the Inferred mineral resource category into the Measured and Indicated categories. Results from this portion of the program are listed in the table below.

Far West and West Zone Pit Expansion Area Drill Results

Footnotes to Drill Tables: (1) Nickel equivalent (Ni Eq. % Total) and platinum equivalent (Pt Eq. g/t Total) calculations reflect total gross metal content using US$ of $6.50/lb nickel (Ni), $2.50/lb copper (Cu), $12.50/lb cobalt (Co), $1200/oz platinum (Pt), $675/oz palladium (Pd) and $1250/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are reflective of the approximate LME 3-year trailing average metal prices. (2) Ni Eq. % Base Metals and Pt Eq. g/t Precious Metals refer to equivalents of base and precious metals respectively, not total metals (3) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (4) Cutoff grade of 0.15% Ni Eq. (5) Internal dilution up to six continuous metres of <0.2% Ni Eq. (6) Notable sub-intervals defined as minimum 20g-m Pt Eq. and 0.5% Ni Eq. Total composite grade (7) Some rounding errors may occur.

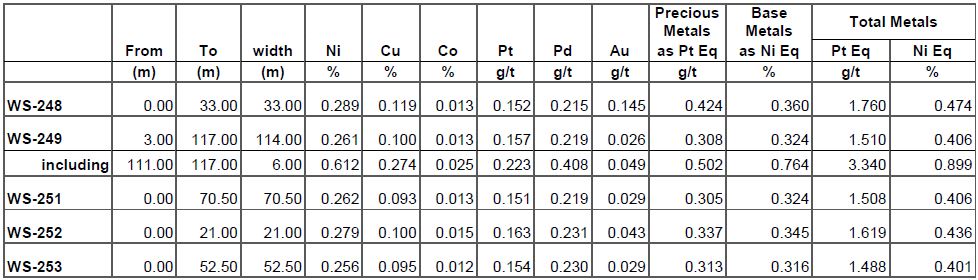

Central Zone Drill Program

A short program of drilling, which explored the main and middle areas of mineralization, was completed in the Central Zone in 2015. Drill hole WS-249 specifically targeted middle area mineralization and intercepted 6.0 metres grading 3.34 g/t Pt Eq. or 0.90% Ni Eq. of basal contact mineralization. We believe that additional drilling is warranted in this area.

Central Zone Drill Results

Footnotes to Drill Tables: (1) Nickel equivalent (Ni Eq. % Total) and platinum equivalent (Pt Eq. g/t Total) calculations reflect total gross metal content using US$ of $6.50/lb nickel (Ni), $2.50/lb copper (Cu), $12.50/lb cobalt (Co), $1200/oz platinum (Pt), $675/oz palladium (Pd) and $1250/oz gold (Au) and have not been adjusted to reflect metallurgical recoveries. The above metal prices are reflective of the approximate LME 3-year trailing average metal prices. (2) Ni Eq. % Base Metals and Pt Eq. g/t Precious Metals refer to equivalents of base and precious metals respectively, not total metals (3) Significant interval defined as a minimum 15 g-m Pt Eq. interval. (4) Cutoff grade of 0.15% Ni Eq. (5) Internal dilution up to six continuous metres of <0.2% Ni Eq. (6) Notable sub-intervals defined as minimum 20g-m Pt Eq. and 0.5% Ni Eq. Total composite grade (7) Some rounding errors may occur.

Summary

John Sagman, Wellgreen Platinum’s Interim President & COO, noted, “The PGM and nickel markets have attractive fundamentals as we believe that today’s depressed market prices have the potential to result in lower production in the future, which in turn will lead to higher prices. Our management team and Board of Directors considers Wellgreen a unique and exceptional project that we believe offers investors exposure to these metals in one of the world’s top mining jurisdictions, with supportive government and First Nations, close proximity to infrastructure and with the potential to be one of the lowest cost producers of PGMs and nickel.”

Corporate Update

Further to its news release dated December 7, 2015, the Company announces that Greg Johnson has resigned from its Board of Directors. The Company expresses its appreciation for Greg’s services and wishes him the very best in all future endeavours.

The Company expects to provide further project and corporate updates in the coming weeks.

Quality Assurance, Quality Control

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). The Wellgreen project geological technical information disclosed herein was prepared under the supervision of Greg Ross, P.Geo., Wellgreen Platinum’s Wellgreen Project Geologist, who is a “Qualified Person” as defined in NI 43-101 and the person who oversees exploration activities on the project. All other technical information disclosed herein was prepared under the supervision of John Sagman, P.Eng., Wellgreen Platinum’s Interim President and Chief Operating Officer and a “Qualified Person” as defined in NI 43-101. In addition, Mr. Sagman has reviewed and approved the technical information contained in this news release.

Wellgreen Platinum executes a quality control program to ensure data verification using best practices in sampling and analysis. Core samples are cut for assay with the remaining sample retained for reference while RC samples are homogenized and split by a cyclone at the drill. Blanks, Standard Reference Material (“SRM”), and duplicates were inserted into the sample stream every 20th or 25th sample. A duplicate sample is created by either quartering core or splitting the crushed sample at the lab. The quartered core is placed into two different sample bags with different sample numbers and sealed. SRM material was prepared and certified by CDN Resource Laboratories Limited. SRMs inserted are CDN-ME-1309, CDN-ME-1310 and CDN-ME-09. Pulp blanks are similarly provided by CDN Laboratories Limited and are CDN-BL-10. Samples are transported in sealed and secured bags for preparation at Bureau Veritas Commodities Canada Limited in Whitehorse, YT. Pulverized (pulp) samples are shipped for analysis to Bureau Veritas Commodities Canada Lt and/or AGAT Laboratories in Burnaby, B.C. Platinum, palladium and gold are determined by lead fusion fire assay with an ICP atomic emission spectrometry finish. Copper, nickel and cobalt are determined by four-acid digestion followed by an ICP atomic emission spectrometry finish. Bureau Veritas Commodities Canada Limited. and AGAT Laboratories are ISO/IEC 17025:2005 accredited laboratories and registered under ISO 9001: 2000 Bureau Veritas Commodities Canada Limited. and AGAT Laboratories are independent from the Company. Quality assurance and quality control are monitored using scatterplots, Thompson-Howarth plots and statistical analysis to ensure duplicates, blanks and standard data are reliable, and indicate robustness of overall results. Bureau Veritas Commodities Canada Limited. and AGAT Laboratories quality-assurance procedures are also included in this process.

About Wellgreen Platinum

Wellgreen Platinum is a Canadian mining exploration and development company focused on the active advancement of its 100% owned Wellgreen platinum group metals (PGM) and nickel project. Located in the Yukon Territory of Canada, the 2015 PEA supports our belief that the Wellgreen PGM and nickel project has the potential to become a large, low cost, open pit producer of platinum, palladium, gold, nickel, and copper. The Wellgreen property is accessible from the paved Alaska Highway, which leads to year-round deep sea ports in southern Alaska.

The Company is led by a management team with a track record of successful large-scale project discovery, development, financing and operation. Our vision is to create value for our shareholders through development of the Wellgreen deposit into a leading North American PGM and nickel producer.

Wellgreen Platinum Contacts:

John Sagman, Interim President & Chief Operating Officer

1-888-715-7528

1-604-569-3634

[email protected]

Cautionary Note Regarding Forward Looking Information: This news release includes certain information that may be deemed “forward-looking information”. Forward-looking information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology, or negative connotations thereof. All information in this release, other than information of historical facts, including, without limitation, statements with respect to our expectation that the drilling programs discussed herein will develop an updated geological model that will form part of a Pre-Feasibility Study, our expectation that the Far West Zone and West Zone RC drilling program will support the conversion of significant tonnes from inferred resource to measured and indicated resource, the results of the 2015 PEA, the size and scale of the Wellgreen deposit as well as our expectation with respect to the low cost of a possible production activity on the deposit relative to other producing mines, future exploration and development of the Wellgreen PGM and nickel project, the undertaking of future activities and work programs at the Wellgreen PGM and nickel project, realization of the potential of the Wellgreen deposit, the active advancement of the Wellgreen PGM and nickel project, and general future plans and objectives for the Company and the Wellgreen PGM and nickel project, as well as statements regarding future PGM economics (including with respect to pricing and supply), are forward-looking information that involve various risks and uncertainties. Although the Company believes that the expectations expressed in such forward-looking information are based on reasonable assumptions, such expectations are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking information. Forward-looking information is based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from the forward-looking information include changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, the Company’s ability to maintain the support of stakeholders necessary to develop the Wellgreen PGM and nickel project, unanticipated environmental impacts on operations and costs to remedy same, and other risks detailed herein and from time to time in the filings made by the Company with securities regulatory authorities in Canada. Mineral exploration and development of mines is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking information. For more information on the Company and the key assumptions, risks and challenges with respect to the forward looking information discussed herein, and about our business in general, investors should review the 2015 PEA technical report on the Wellgreen PGM and nickel project, our most recently filed annual information form, and other continuous disclosure filings which are available at www.sedar.com. Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update any forward looking information, except in accordance with applicable securities laws.

420-1090 West Georgia Street

Vancouver, BC Canada V6E 3V7

© Copyright 2016 Wellgreen Platinum Ltd. All Rights Reserved